Best Career Options for Average Score Students After 12th Commerce

- Afeez Shaik

- Oct 1

- 4 min read

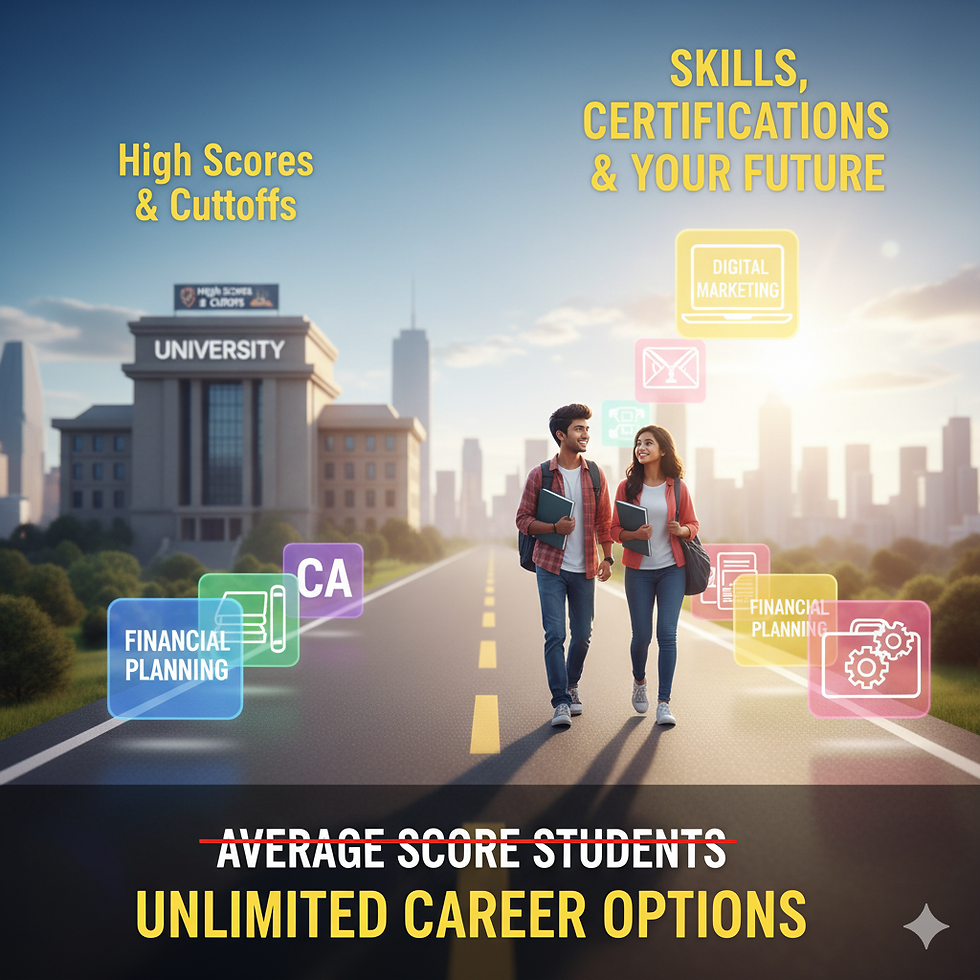

Your 12th Score is a Starting Point, Not a Sentence

If you just finished Class 12th Commerce with what you consider an "average score," and you feel that rush of panic—relax. We get it. The pressure to achieve those high cutoffs is immense, and it’s easy to feel like you’ve missed your chance.

But here’s the truth your teachers might not tell you: Your 12th percentage is a reflection of one exam, one time. Your career success depends far more on the skills you build, the professional certifications you earn, and your sheer dedication after graduation.

For Commerce students, many of the highest-paying and most respected careers are not blocked by average marks. They are unlocked by passing specialized professional exams, where everyone starts from zero.

This guide is your bridge. We will walk you through the top, high-growth career paths that prioritize effort, skill, and certification over your initial 12th-grade score.

1. The Golden Rule: Focus on Professional Courses (Effort > Marks)

For students with average scores, the smartest strategy is to pursue courses where the professional designation holds more weight than the undergraduate college degree. These courses let you start training immediately after 12th.

Career Path | Primary Focus | Why Your Score Doesn't Matter | The Path to Entry |

Chartered Accountancy (CA) | Auditing, Taxation, Corporate Finance | Entry is via the CA Foundation exam, which you can prepare for right after 12th. Your success is based entirely on passing the rigorous Inter and Final exams. | Clear CA Foundation, B.Com (Simultaneously), Article-ship (Internship). |

Company Secretary (CS) | Corporate Law, Regulatory Compliance, Governance | Like CA, the focus is on clearing the multi-level professional exams conducted by ICSI. Requires sharp memory and attention to corporate legal frameworks. | Clear CS Executive Entrance Test (CSEET), B.Com (Simultaneously), Executive & Professional Levels. |

Cost & Management Accountant (CMA) | Cost Analysis, Budgeting, Performance Management | Highly valued by manufacturing and service industries for internal financial strategy. Success is measured by mastery of cost control principles, not high marks. | Clear CMA Foundation, B.Com (Simultaneously), Intermediate & Final Levels. |

Pro Tip: Enroll in a general B.Com degree alongside your professional course preparation. This gives you the required degree while you work toward the high-value certification.

2. High-Demand Degrees for the Management & Service Sector

If the intensive professional courses (CA, CS, CMA) aren't your preference, these traditional degrees offer flexible paths into high-growth sectors. The key is to specialize during or immediately after the three-year course.

Best for: Students with leadership potential, strong communication, and a knack for organizing.

Why it's Great: Many quality institutions offer admission based on a reasonable 12th score and a simple entrance test or interview. Your soft skills shine here.

Career Accelerator: Follow BBA with a specialized MBA, or immediately pursue certifications in high-demand areas like Supply Chain Management, Human Resources (HR), or Finance to secure better roles.

B. Specialized Commerce Degrees

B.Com in Banking and Insurance (BBI): Focuses specifically on the finance sector, preparing you for roles in private banking operations and insurance companies where practical knowledge is paramount.

Bachelor of Hotel Management (BHM): An excellent option for those with great people skills. Admission often relies heavily on your interview performance and personality, virtually eliminating the 12th score barrier.

3. The New-Age Careers (Where Portfolios Beat Transcripts)

The modern economy rewards practical, digital, and analytical skills. These fields offer a huge advantage to average-score students because your portfolio and certifications matter more than your academic transcript.

A. Digital Marketing Specialist

What You Do: Promote products and services online (SEO, Social Media, Content).

Why it’s a Top Pick: This field is rapidly evolving and does not require a specific degree. A B.Com or BBA combined with self-study and certified courses from Google or HubSpot is enough to start a high-paying career. Your practical case studies and results matter more than your college name.

B. Certified Financial Planner (CFP)

What You Do: Advise individuals and families on investments, retirement, and tax planning.

The Advantage: The CFP certification is the actual career requirement. You can pursue this alongside any graduation degree (B.Com/BBA). This is a client-facing role that values trust, financial knowledge, and communication—skills that can't be measured by a 12th score.

C. Data Analytics (Entry-Level)

What You Do: Interpret business data (sales, market trends, consumer behavior) to help companies make decisions.

Your Path: Start with a B.Com or B.A. Economics and immediately begin learning technical skills like Advanced Excel, SQL, and data visualization tools like Tableau or Power BI. Analytical ability is skill-based and can be mastered regardless of your 12th marks.

Conclusion: Take Action, Build Your Bridge

The worst mistake an "average score student" can make is believing their worth is defined by a single number.

Your journey is not about finding an easy college; it's about finding a high-value path that rewards hard work.

Stop Comparing: Ignore the cutoffs and focus on the skills required for the career you want.

Choose a Certification: Pair your graduate degree (B.Com/BBA) with a powerful professional certification (CA, CS, CMA, CFP, or Digital Marketing).

Start Building Skills: Your dedication now is your greatest asset.

Ready to stop feeling confused and start building your future

Comments